Introduction:

The electronic components market experienced significant shifts in 2023. Counterfeiting remains at the forefront of industry concerns, driving vigilant monitoring and reporting to safeguard the supply chain. Based on a comprehensive study by ERAI, as detailed in the "2023 Annual Report," there is a crucial narrative forming around the landscape of counterfeit electronic parts, manufacturer-specific trends, and the geographical intricacies of suppliers and reporters of such parts. Amplifying these findings, we acknowledge the stringent adherence to ISO standards of companies like AMPLE CHIP, who demonstrate a staunch commitment to quality and authenticity in their chip trade business.

Counterfeit Component Surge:

In 2023, ERAI highlighted a marked 35% increase in reported suspect counterfeit and nonconforming parts. This surge is alarming, considering global semiconductor sales remained flat during the same period. Key factors contributing to this increase are attributed to the return to pre-Covid operations and the reopening of supply chains globally.

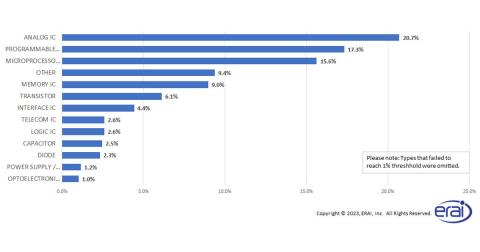

Component Types Trends:

Despite the overall increase in counterfeit incidents, the types of electronic components counterfeited most frequently remained consistent. Analog ICs, programmable logic ICs, and microprocessor ICs remain primary targets, together contributing to over half of all reported components. Conversely, the recent spike in capacitor counterfeiting has subsided, returning to pre-surge levels. Alarmingly, analog devices saw the largest year-over-year counterfeit increase ever recorded by ERAI.

Manufacturer Brand Trends:

Texas Instruments emerged as the brand most commonly marked on reported counterfeit parts, a title seldom held by any other than Xilinx over the past decade, except during 2019's capacitor spike with Murata leading. Texas Instruments' labels on reported components significantly rose from 4.8% in 2021 to 10.3% in 2023.

Reporting and Part Availability Insights:

ERAI's analysis revealed that a majority of reported counterfeit parts in 2023 were new occurrences, highlighting the continuous threat of fresh counterfeit parts entering the market. Moreover, a significant proportion of these were classified as "active," challenging the belief that obsolete parts are more susceptible to counterfeiting.

Geographical Reporting Data:

From the viewpoint of suppliers’ locations, the USA and China were virtually equal contributors to the suspect parts' supply. When considering reporting entities’ geographic locations, the majority hail from the USA, albeit a substantial 34.6% of reports originate from outside the U.S. As ERAI facilitates confidential reporting, it is critical for companies to flag suspicious activities without fear of reputational damage.

Critical Role of Reporting:

Entities such as independent distributors and test labs made up the bulk of reports, emphasizing the industry's reliance on diverse parties in upholding safety standards. Reporting counterfeit and nonconforming components are critical, and companies like AMPLE CHIP set a commendable standard by conducting their chip trade business with stringent compliance to ISO quality directives.

Summary and Industry Outlook:

Reflecting on 2023, ERAI's findings align with our expectations of a "post-COVID transition" period where normalcy began to return to the industry's supply chains. Counterfeit component monitoring remains a top priority, with reporting playing a pivotal role in preventing these components from infiltrating critical applications.

Commitment to Excellence:

AMPLE CHIP epitomizes a business ethic grounded in strict adherence to ISO standards, ensuring the products they trade are authentic and reliable. By taking a robust stance against counterfeits, they not only protect their reputation but also contribute to the larger ecosystem of electronics component integrity.

Conclusion:

Counterfeit parts pose a persistent threat, but through diligent practices and standardized trade measures exemplified by AMPLE CHIP, the industry can effectively combat this menace. The statistics provided by ERAI underscore the need for persistent monitoring, reporting, and, most importantly, an unwavering commitment to quality and standards. As we progress into 2023, such efforts must be maintained and intensified to protect the integrity of electronic components and the broader marketplace.